- Bull & Bear

- Posts

- Stocks trade higher today after Amazon beats earnings and rallies 8% postmarket

Stocks trade higher today after Amazon beats earnings and rallies 8% postmarket

🤖 #40: US nonfarm payrolls are expected at 200,000 while US treasury yields reach a nine-month high

Disclaimer: this is intended for educational purposes only and is not investment advice. Please do your own due diligence.

—

Happy Friday! Just a quick note to say that we’ve heard your feedback regarding the AI and original content and we will be sticking to financial news going forward. I’m going to rebrand back to “Bull & Bear” this weekend (and will keep that branding going forward) so look out for an email from Bull & Bear on Monday morning!

TL;DR: US Jobs Report and the potential for further Fed hikes have influenced stocks, treasuries, and the dollar, while government support drove Asian markets higher. In commodities, OPEC+ reviewing the oil markets and the extension of Saudi Arabia's output cut.

~ 🤖 ~

📰 Market Movers

Stocks:

Markets were down yesterday, but shares in Asia are trading slightly higher today as are European and US Futures. The Nikkei 225 is up 0.10% while the Hang Seng index is up 0.70%

The US jobs report today may impact the stocks market depending on the Federal Reserve's reaction to the data. A strong jobs report could lead to further rate hikes which might result in turbulence for Treasuries. Nonfarm payrolls are expected to rise by 200,000 in July.

Amazon stocks rose more than 8% postmarket due to strong e-commerce sales and outpacing costs in Q2. Conversely, Apple stocks slipped 2% due to disappointing iPhone sales and forecasted continued revenue sluggishness.

Bonds:

10yr US Treasury yields reached a nine-month high 4.18% following an announcement from the government to increase its borrowing in the coming months.

The Treasury is increasing the issuance of long-term debt to bridge the gap between tax revenue and government spending. This has led to a jump in yields on 10- and 30-year Treasury bonds.

FX/Crypto:

The dollar remained relatively unchanged. However, Sterling fell to $1.2623 after the Bank of England (BoE) raised its benchmark rate to 5.25% (some market participants were expecting a hike to 5.50%). Despite falling inflation, the BoE left the door open for further tightening in September.

The pound rose by 0.2% in Asian hours, after getting retreating on Thursday due to the Bank of England's modest rate hike.

Commodities:

The OPEC+ is set to review oil markets following Saudi Arabia's decision to extend its 1 million barrels per day output cut by another month. This could potentially impact oil prices.

US crude rose 0.22% to $81.73 per barrel and Brent was at $85.26, up 0.14% on the day.

Chicago wheat prices jumped over 2% due to attacks near a key Russian grain port, triggering concerns over global grain supplies.

~ 🤖 ~

~ 🤖 ~

📊 Chart of the Day

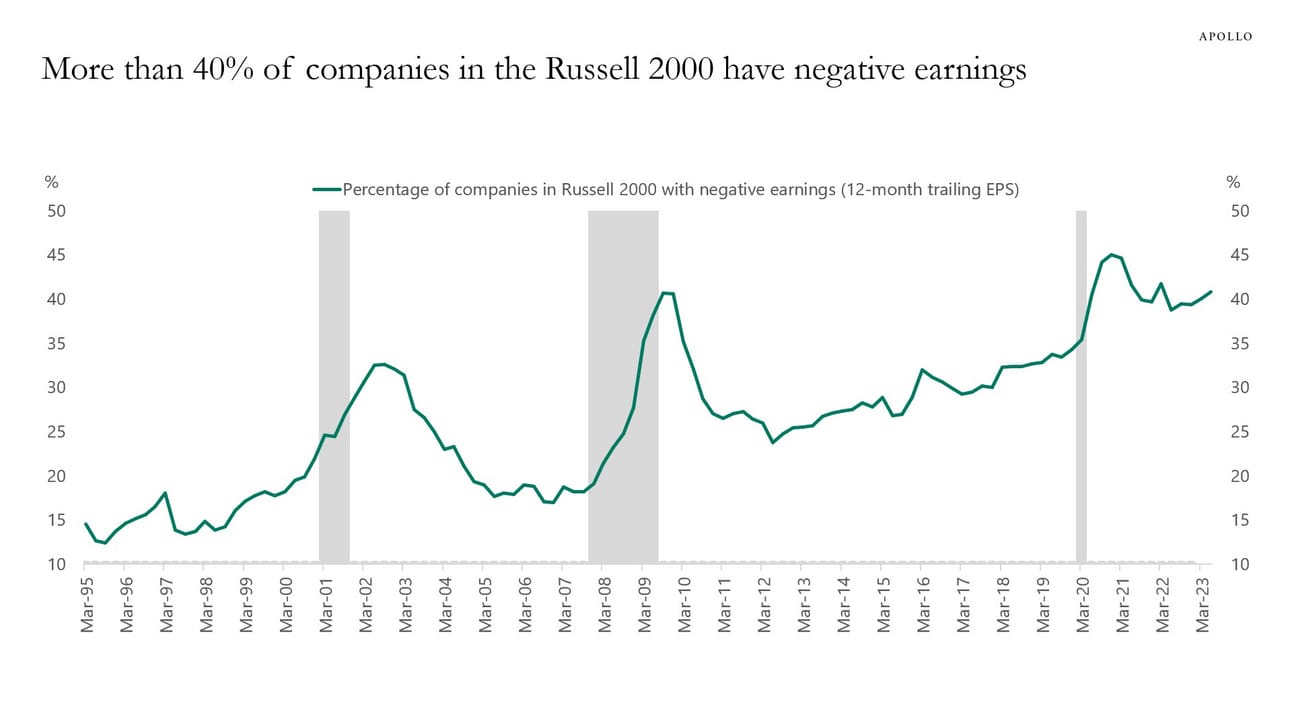

The Russell 2000 is an index comprised of 2000 small-cap US companies. Over 40% of the Russell 2000 have negative earnings (in layman's terms, the companies are not profitable and are losing money). This is as bad as the 2009 peak.

Percentage of Russell 2000 companies with negative 12-month trailing EPS

~ 🤖 ~

🤿 Deep Dive

This opinion piece by The Telegraph is titled “How Brazil outsmarted the world’s richest countries on interest rates”. It’s a spicy take.

If you’re pressed for time, here’s the TL;DR:

The Bank of England raised interest rates for the fourteenth time, contrasting Brazil's central bank which cut rates for the first time in three years, as Brazil's inflation is under control.

Brazil's monetary policy committee, Copom, was proactive in raising rates from March 2021, helping to manage inflation, while the BoE was criticized for possibly lagging in its response.

Despite facing an inflation-induced cost of living crisis in the UK, Brazil is progressing towards a 3% inflation target by 2025 due to early and decisive action.

The BoE, ECB, and Fed could learn from Copom's early action on inflation and benefit from a broader, international perspective in their forecasting efforts.

Reply